Let’s be honest. As a freelancer, you’re already juggling invoices, chasing clients, and navigating a sea of 1099s. Adding cryptocurrency into the mix? It can feel like you’ve just been handed a second, far more confusing job. The tax rules are murky, the record-keeping is intense, and the fear of making a mistake is real.

But here’s the deal: crypto isn’t going away. And for gig workers, it can be a powerful tool for receiving payments, investing income, or even just exploring new financial frontiers. The key is to not let the tax tail wag the dog. With a few smart strategies—think of them as your financial roadmaps—you can navigate this landscape confidently and keep more of what you earn.

The Freelancer’s Crypto Tax Reality Check

First, a crucial mindset shift. The IRS views cryptocurrency as property, not currency. That means every single crypto transaction—yes, every single one—is a potential taxable event. It’s not just when you cash out to dollars. If you get paid in Bitcoin for a design project, that’s income. If you later use some of that Bitcoin to buy Ethereum, that’s a sale (and possibly a gain or loss). It’s a lot.

For freelancers, this creates two main tax layers: income tax and capital gains tax. You need to account for both.

Layer 1: Income from Crypto Payments

When a client pays you in crypto, you’ve earned ordinary income. The amount you report is the fair market value of that crypto in U.S. dollars at the moment you received it. Let’s say you complete a consulting gig and receive 0.05 BTC. If Bitcoin is trading at $60,000 that day, you’ve just earned $3,000 in taxable income. You report that on Schedule C, just like you would with a cash payment.

Your cost basis for that crypto—the value you’ll use later to calculate gains or losses—is also that $3,000. Jot down the date and the price. Seriously, write it down now.

Layer 2: Capital Gains & Losses

This is where it gets intricate. Once you own that crypto, any subsequent disposal (selling, trading, even using it to buy a laptop) triggers a capital gain or loss. The calculation is: Sale Price – Cost Basis = Gain/Loss.

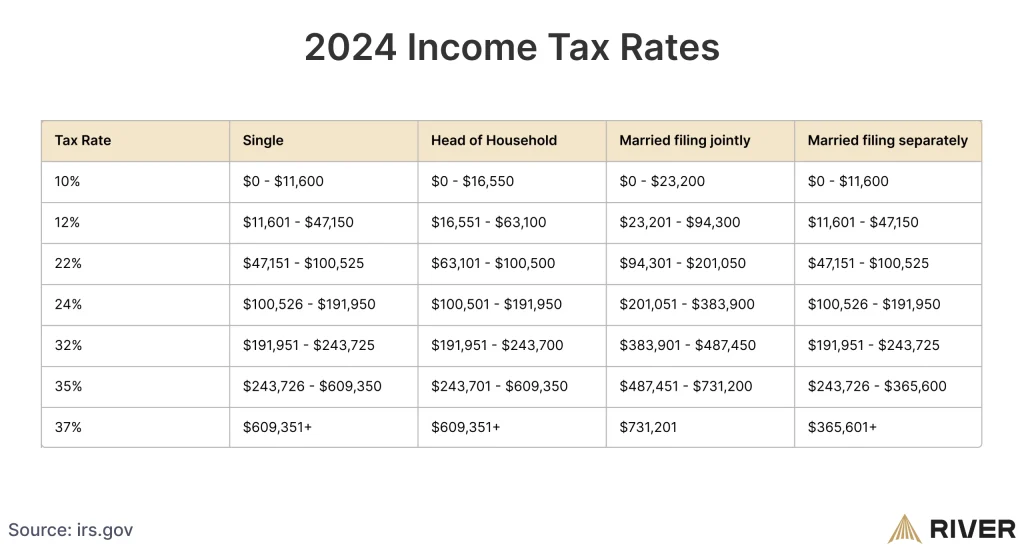

If you held the asset for over a year, it’s a long-term gain (usually lower tax rates). Under a year? It’s short-term, taxed at your ordinary income rate—which, for many freelancers, can be notably high.

Smart Strategies to Implement Today

Okay, the scary part is out of the way. Now, let’s talk action. These aren’t loopholes; they’re practical, defensible methods to manage your liability.

1. The Non-Negotiable: Meticulous Tracking

You can’t manage what you don’t measure. For every transaction, you need:

- Date & Time: The exact moment of the transaction.

- Type: Was it income? A trade? A purchase?

- Amount in Crypto: How much BTC, ETH, etc.

- USD Value at That Moment: This is your critical data point.

- Fees: Transaction fees can often adjust your cost basis.

Honestly, manual spreadsheets become a nightmare fast. Using a dedicated crypto tax software that syncs with your wallets and exchanges is worth every penny. It automates the data collection and does the brutal math for you.

2. Choosing Your Cost Basis Method

This is a powerful, often overlooked lever. The IRS allows different methods to determine which specific coins you “sold” when you dispose of part of a holding. For freelancers receiving frequent, small payments, this matters.

FIFO (First-In, First-Out) is the default. The first coins you bought are the first ones you sell. It’s simple but may not be optimal.

Specific Identification (SpecID), however, lets you choose which exact lot of coins you’re selling. Did you buy some at a high price and some at a low? With SpecID, you can sell the high-cost-basis coins to minimize a gain or maximize a loss. The catch? You must explicitly identify the lot at the time of sale and have the records to prove it. Your tracking software is essential here.

3. Harnessing Tax-Loss Harvesting

The crypto market is volatile—a rollercoaster, really. That volatility can be used strategically. Tax-loss harvesting involves selling crypto that is at a loss to offset your capital gains (or even up to $3,000 of ordinary income).

Example: You have a $2,000 gain from trading some Ethereum. But you also have an old altcoin investment that’s down $1,500. Selling that altcoin creates a capital loss that can directly offset your Ethereum gain, reducing your tax bill. Just be mindful of the wash-sale rule… which, well, currently doesn’t apply to crypto (but it might someday, so stay alert).

4. The Quarterly Estimated Tax Dance

This is a freelancer classic, amplified by crypto. Since taxes aren’t withheld from your gig income—or your crypto gains—you’re required to pay estimated taxes quarterly. If you have a big crypto gain in Q2, you may need to factor that into your June 15th estimated payment. Failing to do so can lead to penalties. It’s a pain, but proactivity is your shield.

A Quick-Reference Table: Crypto Activity & Tax Impact

| Activity | Tax Category | What To Report |

| Get paid in crypto for a gig | Ordinary Income | Fair market value at receipt (Schedule C) |

| Sell crypto for USD | Capital Gain/Loss | Difference between sale price and cost basis (Schedule D) |

| Trade BTC for ETH | Capital Gain/Loss | Disposal of BTC is a taxable event |

| Use crypto to buy goods | Capital Gain/Loss | Disposal of crypto at time of purchase |

| Holding (not selling) | No immediate tax | N/A |

Common Pitfalls to Sidestep

Even with the best plans, it’s easy to stumble. A few warnings:

- Thinking Small Transactions Don’t Count: They do. That $10 in Bitcoin you used to buy a digital asset? It’s a reportable event.

- Ignoring Airdrops & Staking Rewards: These are generally taxable as ordinary income at their value when you receive them. A surprise, often an unwelcome one.

- Mixing Personal & Business Wallets: Keep them separate. The commingling of funds is an accounting nightmare waiting to happen. Create a dedicated wallet for freelance crypto income.

Wrapping It Up: Your Path to Confidence

Look, navigating cryptocurrency tax strategies as a freelancer isn’t about finding a magic trick. It’s about building a system. A system of relentless tracking, strategic planning, and educated decision-making. It’s treating your crypto activity with the same professional rigor you apply to your client work.

The landscape is still evolving, sure. Regulations will change. But the foundation—meticulous records, understanding your cost basis, and planning for liabilities—will always serve you. By taking control now, you transform crypto from a tax-time terror into just another managed part of your vibrant, independent financial ecosystem. You’ve got this.

More Stories

The Intersection of AI Agents and Autonomous On-Chain Economies

The Rise of Intent-Centric Architectures and Solver Networks in Decentralized Finance

The Intersection of Decentralized Finance and Traditional Wealth Management for Accredited Investors